Categories

Resource Links

GIR's Investing in the New Europe

GIR's Investing in the New EuropeBloomberg Press, 2001, "Sound, practical advice."

Wall Street Journal Europe

Grabbing The Gold

Barron’s Hedge Funds – A Monthly Report

by Eric Uhlfelder

“EVERYTHING ABOUT FENCING IS UNNATURAL,” EXPLAINS JIM MELCHER, Cheif Investment officer and head of global macro hedge fund Balestra Capital. “You have to retrain your instincts to respond counterintuitively, very much like managing money.” The discipline has helped him succeed at both. Melcher, 69, was a two-time national épée fencing champion and a member of the U.S. Olympic team in the terror-scarred 1972 games in Munich. (An épée is a type of sword.) Betting against the crowd, he has also carved out gold-medal returns: His $850 million fund soared nearly 46% last year, topping the average global macro hedge fund by a whopping 47.6 percentage points and the Standard & Poor’s 500 by nearly 83 percentage points. Returns like those earned Balestra a fourth-place finish in Barron’s Hedge Fund 75 leading performers of 2007.

More importantly, this wasn’t just a single lucky thrust. Since the fund’s inception in 1999, Melcher has posted annualized returns of 33% from long and short investments in commodities, currencies, equity and debt indexes, interest rates, and credit-default swaps (CDS). In contrast, the stock market over the past decade was off an average of 1.38% a year. And so far this year, the New York-based fund is still delivering strong returns, up 6.64% through February, thrashing the S&P 500 by 24.82 percentage points.

Here’s how he does it.

“The one thing that probably distinguishes our approach to investing,” says Melcher, “is that we’re always open to change when informed by regular, objective reviews of data and trends affecting markets.” He doesn’t get bogged down by any strategic biases. Instead, he primarily invests in highly liquid securities that can be sold within hours. The result is a fluid investment approach that enables the fund to turn on a dime.

Another big difference: Whereas many global macro managers are trend-followers, Melcher relies on his discretion, without any buy or sell triggers. He pays lots of attention to risk, using options to minimize it. “Options play a key role in our portfolio, to gain exposure with limited downside and to hedge overall positions,” he explains.

The investment manager does everything possible to understand the overall direction of markets, restricting exposure to a particular investment theme to no more than 15%of the portfolio and liquidating positions if they’re causing losses to exceed 3% to 5%. Further, management stress-tests all holdings weekly to see how they would fare under extreme scenarios.

Butyou couldn’t discern Melcher’s strong focus on risk through traditional metrics. Balestra’s historic annualized standard deviation, a measure of volatility of the fund’s average annualized return over a given period, is nearly 40%. In contrast, the S&P 500’s annualized deviation over the past 10 years is just 6.76%. Balestra’s staggering figure is a result of the fund’s consistent upward trajectory. The fund’s Sortino ratio, which corrects for this bias in calculating risk-adjusted returns, is 3.47%. Since 2000, the S&P 500’s ratio has been minus 0.47%.

One of the fund’s worst experiences came in 2006’s third quarter, when it shorted high-yield bonds. “At the time, risk was barely being priced into the market, with spreads for junk having collapsed to 300 basis points,” recalls Matt Luckett, a general partner in the fund. “So we shorted the CDX Index, which tracks the spreads of 100 high-yield bonds.

With the annual cost of carry averaging 3%-and huge confidence in this play-the partners soon amassed nominal exposure (based on the total value of derivatives contracts) that exceeded the fund’s assets. But within two months, spreads contracted to 230 basis points. Subsequent liquidation of the position contributed to 2006’s coming in as the fund’s only losing year-down 3.8%.

The investment thesis wasn’t wrong; it was just early. Spreads eventually did blowout to 1,600 basis points. “Being right wasn’t enough,” says Melcher. “You cannot stay in a position very long that has a high carry cost, especially as it starts to move against you. We were able to adjust to a much lower carry, yet get bigger potential gains by shifting to the mortgage-backed bond area.”

The fund started buying credit-default swaps on double-A-rated mortgage-backed bonds of collateralized-debt obligations at an annual carry of 60 basis points in autumn 2006. “This was a cheap way to gain exposure to the impending housing crisis that we felt would be so severe, even the highest quality tranches [particular slices of the CDOs] would get hit,” remembers Melcher. As the housing market melted down, the price of the CDS soared. Balestra made $180 million from the investment, which helped fuel the fund’s 199% gain in 2007.

The fund’s group-investment approach is a top-down process involving all four of the firm’s investment professionals- Melcher, Luckett, Norman Cerk, and Ryan Atkinson -tracking key macro and trading trends. Through most of the second half of 2008, it led the fund to a long dollar position. Besides seeing the commodity bubble continue to deflate, the team believed that global financial deleveraging would be largely done in greenbacks, therefore pushing up demand for the buck. The long dollar position generated about one-quarter of the fund’s 45.78% gain for the year.

In late 2007, Balestra shorted financials through the exchange-traded funds Financial Select SPDR ETF (XLF) and SPDR KBW Regional Banking ETF (KRE). “While regional banks did not have the same subprime-mortgage exposure as their large cap brethren, and were far less involved with securitizations and other opaque financial engineering,” says Luckett, “they did have substantial commercial-real-estate exposure that’s now getting hurt.” These two short positions were responsible for about 10% of the fund’s profits last year.

In spite of Balestra’s strong start this year, Melcher is very bearish about the U.S. and global economies. He believes the current crisis is the worst since the Great Depression. While he supports President Barack Obama’s stimulus package, he thinks the government still doesn’t grasp what needs to be done. “Policy makers must let the markets clear by themselves instead of trying to reignite more borrowing and spending. Excess stimulus may just create more problems later on.”

Melcher believes the problem ultimately stems from previous Federal Reserve policies that ensured plenty of liquidity instead of permitting periodic economic contractions to burn off weak entities and force companies to restructure.

While this outlook suggests there could be more “black swans”-rare, but crucial, events-on the horizon, Balestra, in business since 1979, has avoided such hits through some very prescient shifts into cash. Balestra first took that route before the credit crisis in 1981; then in 1987, just before global stock markets collapsed; and again right before Russia defaulted on its debt and Long-Term Capital Management blew up in 1998. The fund was also out of tech stocks before the sector started to tumble in 2000.And its short positions in 2007 and ’08 helped it rack up two-year cumulative gains of 245%.

Although he’s a believer in the importance of asset allocation, Melcher thinks that security selection has become close to irrelevant-that there’s a greater need for broad market judgment rather than rigid portfolio modeling. Accordingly, he’s convinced that global macro will remain the most meaningful investment strategy throughout this crisis and beyond.

Still, Melcher is keeping his powder dry, with less than half of his assets currently invested, and with reliance on limited-risk derivatives. He sees opportunities in certain high-grade corporate bonds. At the same time, he’s still holding large positions in CDS of foreign corporate and sovereign bonds, betting risk premiums will rise, as well as some puts on U.S. and international equity indexes, anticipating that they’ll fall further.

The fund has no problem waiting on the sidelines. “Capital preservation trumps our other concerns,” says Melcher. “We’re always focused first on how much we can lose.”

ERIC UHLFELDER covers capital markets

from New York.

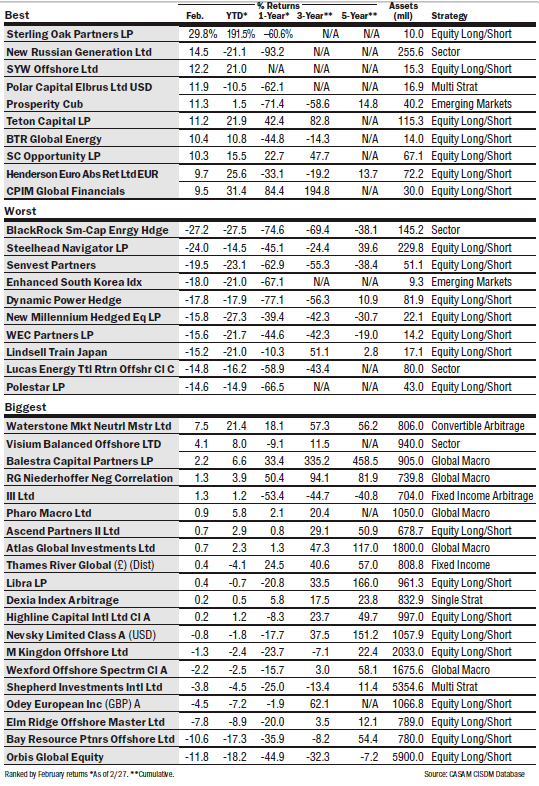

Snowball’s Chance In February

Some hedge funds enjoyed a solid February, after surviving last year’s rout, with top performer Sterling Oak Partners surging 29.8%. But the 10 worst performers fell by double-digits. Among the 20 biggest funds, more than half eked out gains, with Highline Capital International edging up 0.20% for the month.

___________________________________________________________________________________

1st Page of Balestra Article, 2nd Page of Balestra Article <- Links to the Original Article. Page 1 and 2 respectively.

Tags: Argonaut, Balestra Capital, Barnegat Fund, Closed-end funds, Commodity Trading Advisors, Finisterre, Global macro, Hedge funds, mutual funds, Partners, Risk management, Xerion Fund

This entry was posted on Saturday, September 12th, 2009 at 4:14 pm and is filed under FUNDS. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Search

Opalesque Interview of Eric Uhlfelder