Asgard Fixed Income Fund

20 November 2011, Barron’s

When his wife and mother of their three young children passed away from cancer at the heart-breaking age of 34, Morten Mathiesen was never made more aware that terrible, unexpected things can happen.

Shouldering even greater responsibility as a lone parent further colored his sense of risk and the way he manages the €171 million Danish Asgard Fixed-Income Fund. This was especially evident during the early stages of the financial crisis when, in 2008, he (and his partners at the time) decided to shift his advisory firm, Nordic Asset Management, under the auspices of one of Scandinavia’s largest pension funds, which was looking to buy registered asset manager. “I thought this would be a safer way to operate the fund and care for my family,” he explains.

By early 2009, Mathiesen was working for Danish PFA Pension, which has $55 billion in assets. PFA bought Mathiesen’s firm to have claim to a registered asset manager and to bring a hedge fund into its fold. In addition to having the support of a large institution behind him, Mathiesen also thought the deal would drive asset growth.

During the recovery, Mathiesen felt PFA had become reticent about directing clients into the hedge fund. When the initial two-year contract had passed, a deal was struck that enabled Asgard to reappoint Mathiesen and his 5-person Copenhagen-based team as the independent advisor.

The ironic part of this story is that Mathiesen, now 39, had altered his investment strategy just before teaming up with PFA, which transformed his fund’s performance from sub-par to remarkable.

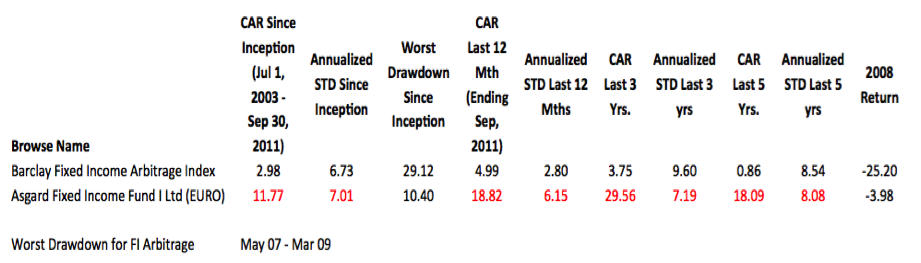

Between 2003 and 2007, Asgard returned an average of 3.78% a year. In 2008, when he initiated the strategy shift as global credit markets froze, his fund lost less than 4%. The BarclayHedge Fixed-Income Arbitrage Index was off by more than 25%. Mathiesen was able to weather the financial crisis due to favorable spread movements on his financing. His borrowing costs went down, tracking central bank cuts of overnight rates. But interbank rates climbed as banks started to fear one another, demanding higher returns from their interbank lending. “At one point, the spread hit 200 bps,” Mathiesen recalls, “and the dislocation remained for nearly a year.”

Over the trailing 3 years through September 2011, Asgard has produced annualized returns of 29.56%, having outperformed the index by 25.81% a year. During that time, the fund’s annualized volatility was averaging 7.29% versus the Index’s 9.60%. And his worst drawdown was 10.4% in 2008; the index’s was 29.12%.

“This kind of performance transformation rarely ever happens,” observes NY-based fund of funds manager Jonathan Kanterman, “without appointment of a new portfolio manager or a complete change in strategy.”

Mathiesen credits this change of fortune to a more focused strategy. When he started the fund, his relative value approach was complemented with directional macro, volatility trading, yield curve, and event driven investments. But by 2007, Mathiesen realized these secondary strategies had been holding back performance. Starting in 2008, he transformed the fund from 60% to 100% relative value.

He was indubitably helped as well by the way interest rates have realigned since the financial crisis landed on Nordic shores in 2008. As central banks started cutting rates, spreads between bond and swap rates–the core of his investments–started moving very much in Mathiesen’s favor, which he enhanced through leverage.

In a low-interest rate environment, Mathiesen says there are two basic bond hedge fund strategies: one that buys higher yielding instruments enhanced with some leverage; the other significantly levers up low-risk bets. Risk of the former is focused on the debtor; the latter, on the market and the potential of a black swan event that could deck a highly geared fund.

Focusing on high-grade short-term securities since its inception in 2003, Asgard applies 20 to 30 times leverage (currently at 23) on investments that typically last from 2 months to a year. He delevers when confronted with abnormal volatility. And he keeps half his assets in unencumbered cash to meet margin calls so he’s not forced to sellout of positions when spreads start moving against him.

Currently, nearly three-quarters of Mathiesen’s portfolio is made up of mortgage-backed securities known in Scandinavia as covered bonds. The balance is comprised of government bonds and interest rate swaps.

While this may not sound risk-adverse to Americans, the mortgage market is a very different creature in Scandinavia. And therein lies the logic of this fund and the reason why Mathiesen feels secure running up leverage.

Bank underwriters stay permanently attached to these securities, required to recapitalize them to ensure loan-to-value ratios don’t rise above 80% for residential mortgages and 60% for commercial mortgages. (Asgard invests predominantly in residential securities.) High-rated covered bonds are considered so secure that regulators permit their use by banks to meet core capital requirements.

Mortgages are attached to people as well as to properties. That creates a far more stable and healthier housing market built on actual investor fundamentals. Reinforcing the housing market’s integrity, Scandinavians rarely ever file personal bankruptcy. And the region’s substantial social safety net helps households continue payments when unemployment or sickness strikes.

Exposed to covered bonds with average maturities of less than two years, Asgard focuses on the lower volatile end of the yield curve to minimize margin call risk associated with falling bond prices. Mathiesen diversifies his financing across Scandinavia’s five large banks, which are generally deemed healthier and better capitalized than most other western banks.

A prototypical trade, currently the fund’s largest, is long SEK 7 billion of AAA-rated Swedbank-issued covered bonds–the continent’s most liquid. Believing two-year rates would decline relative to interest rate swaps, Asgard established a position in October when the security’s current yield was 2.3% on a 24-month bond. The corresponding swap rate, which hedges the fund’s interest rate exposure, cost 2.055%. This netted a difference of 25 basis points (bps).

The floating rate side of the swap pays Asgard a higher 3-month STIBOR (Stockholm Interbank Overnight Rate) of 2.51%. This is more than the 2.25% rate Asgard pays to finance the bond purchased through the Repo market. The reason for this lower rate: the bond is used as collateral. The 26 bps difference boosts Mathiesen’s total projected annual return to 51 bps.

He’s applying one-fifth of the fund’s 23 times leverage to the position. When the bond yield declined 5 bps more than the swap rate in one month, it increased the fund’s overall value by 0.56%. This reflects an annualized rate of return for the entire fund of nearly 7 percentage points.

Working with his credit research analyst and trader, Mathiesen relies on computer modeling to discern credit and financing opportunities. They analyze markets within Scandinavia and across Europe and the US to help identify trends that may produce desirable trades. And they’ve developed a proprietary optimization model to help them rotate in and out of positions to enhance returns and reduce risk.

They recently found opportunity in an interest rate swap involving the Danish kroner and the euro. The kroner is pegged to the euro. With investors looking at Denmark as a safe haven, this is putting downward pressure on Danish interest rates–the main tool for sustaining the cross rate.

Mathiesen went long 6-month Danish rates and short 6-month euro rates. When the European Central Bank cut rates in early November by 25 bps, the Danish Central Bank responded by reducing policy rates by 35 bps. This produced a gain that has accounted for 1.1% of the fund’s total returns. And Mathiesen believes the play will realize further gains as the eurozone continues to struggle and more investors flock to kroner-denominated securities. This will likely force Danish central bank authorities to lower rates even further to maintain the kroner’s link with the euro.

In June 2010, the fund went long 10-year Swedish government bonds because Mathiesen thought rates would decline. The government had uncharacteristically run a budget deficit in 2009 of 0.9% of GDP. But Mathiesen saw the economy rapidly recovering from recession. This would likely reduce the government’s issuance of longer-term debt, leading to higher 10-year bond prices.

In 2010, the budget deficit had fallen to -0.3% of GDP and is expected to turn to surplus this year. Bonds have rallied. When Mathiesen sold his position in April 2011, the investment had contributed 1.3% to the fund’s total returns.

Asgard’s focus on one of the healthiest regions in the developed world can uniquely diversify portfolios. But there is no economic fence that can fully shelter a region from blowback if the eurozone pulls apart. European Union adoption of stricter banking regulations may restrict the degree of leverage banks can offer investors buying covered bonds. And as fund managers with or without families have discovered, markets are capable of temporarily mispricing even the soundest assets and see various interest rates disconnect from each other, either one of which can have disastrous affects when portfolios’ are highly leveraged. But Mathiesen has so far proven up to the task of balancing risk and reward.

GIR's Investing in the New Europe

GIR's Investing in the New Europe